United States – On Tuesday, the US Consumer Financial Protection Bureau (CFPB) received a jurisdictional boost when a federal judge in Texas relegated an industry-backed lawsuit challenging the agency’s rule to fix credit card late fees at USD 8 to another court in Washington DC, as reported by Reuters.

Boost for CFPB Jurisdiction

The initial change came on Friday when the 7th Circuit Court of Appeals, the court that had blocked Pittman from transferring the case again, relinquished jurisdiction and handed the matter back to the lower court.

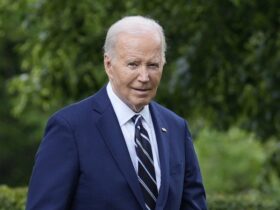

That could help the CFPB at home as it stands to defend as one of the parts of President Joe Biden’s effort at cracking down on ”junk fees” against the callbacks from the U. S. Chamber of Commerce and the American Bankers Association.

For months, the CFPB had been seeking to transfer this case out of the federal court of the Western District of Texas, Fort Worth. This court remains a favorite of the parties seeking to counter the Biden administration and has only two sitting judges—both of whom are Republicans.

The CFPB refused to make any comment. The Chamber of Commerce couldn’t be reached for this article and didn’t provide any comments.

CFPB’s Legal Maneuver

The rule is that no card issuer with over 1 million open accounts may charge more than USD 8 for being late unless the card issuer can justify that it is, in fact, expensive for them to do otherwise.

The CFPB pointed out that issuers received more than USD 14 billion in credit card late fees in 2022, with an average fee of about USD 32.

Pittman, a Trump nominee, stopped the rule from being implemented on May 10th.

But he did so only after a panel of the New Orleans-based 5th US Circuit Court of Appeals, which Trump has stocked with younger judges, overruled a decision he had issued to relocate the case to the nation’s capital.

That was the only ground on which Pittman could justify its decision to block the rule: it made the same argument in another case in 2022 that the CFPB’s funding structure was unconstitutional — which meant that any rules it issued were also unconstitutional.

CFPB’s Response

That 2022 ruling was eventually reversed by the US Supreme Court on May 16. In response, the CFPB has stated that it intends to file for the lifting of the injunction that Pittman compiled as a result, though the industry groups have presented other arguments yet to be used to prevent the rule.

Thus, when the 5th Circuit later returned the credit card fee case to Pittman anyway, the CFPB on Tuesday requested that he forward it to Washington, as reported by Reuters.

He did so within three hours, arguing that the case mostly concerns nonresident plaintiffs who sue actions of state officials performed in Washington. The only link to Fort Worth was a local party, the plaintiffs, the ‘Fort Worth Chamber of Commerce.’