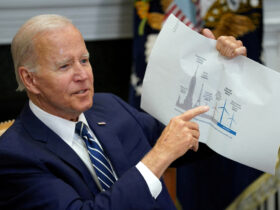

United States: On Monday, the Biden administration introduced a new package of measures that would erase the student debt for over seven million Americans.

The administration argues that in full implementation, the number of borrowers who, during the president’s term, have seen some of or all of their debt forgiven would exceed 30 million.

More about the new policy

The new policy, which hopes to take the place of one that was overturned by the US Supreme Court last June, provides relief to specific groups considering their level of debt, with a focus on those who’ve had debt for many years and the ones who have been unable to make payments.

Even borrowers who are not well-off socially could benefit from high-interest balances, as NPR News reported.

According to Miguel Cardona, the US Education Secretary, the novel proposition will satisfy the promise that the president had made earlier during her candidacy period in 2020.

Further added, the reliance that would be provided would mean offering a “breathing room” for many borrowers. “It means freedom from feeling like your student loan bills compete with basic needs like grocery or health care.”

The announcement spelled out efforts aimed at four groups of borrowers: the ones who, after paying for a certain period, will be left with more debt, the ones who have been already paying for more than 20 years now, the ones already eligible for already existing forgiveness or cancellation programs as well as the ones with difficulties in supporting their families.

The new policy will address the “runaway interest”

According to NPR News reports, more than 25 million borrowers will now owe more in student loans than they took out, according to the administration. Added to that is “the runaway interest” Cardona described. The administration’s plan intends to eliminate up to USD 20,000 in interest for borrowers on any income level.

On the one hand, the remainder is exactly that part that loan repayments by low and middle-income employees will be performed under an income-driven repayment plan. This specific group of borrowers contains single individuals who earn USD 120,000 and USD 240,000 per year each.

As per an estimation of the administration, the proposed policy would forsake some pending interest balances for 25 million borrowers, including 23 million enjoying full forgiveness on their interest. Presently, more than 43 million Americans have one form or another kind of student loan debt.

Persistent efforts by Biden to provide debt relief

The US after Biden has been working on delivering student loan debt in a wide range of manners since they became a power. Probably the most memorable thing was in 2022, the head of the state sent out an announcement, with which he aimed to nullify up to $20,000 of the debtors’ qualifying debt.

Millions of borrowers filled out the form to opt-in, and the project started off optimally. However, it came to a screeching halt because legal battles ensued. However, the Supreme Court shut down this plan in June 2023, expressing concerns that it disproportionately harmed low-income communities, NPR News reported.

This new plan was in the making for some time, for the Education Department has been involved in what is called “negotiated rulemaking” to design a new method for debt relief ever since the initial plan was declared unacceptable in June.

Further, they have been receiving hints from stakeholders, advocates, and critics beforehand in order to make the final announcement for the plan.

The new proposals are expected to take some time, and they will require some waiting before it’s possible for all qualified borrowers to stop paying their debts altogether. The Education Department or agency should seek public commentary on its proposal before it announces or unveils its final version of the education plan.

Other than the legal ones, this rulemaking process is what can make the rule robust and more likely to overcome the legal loophole that can be exploited from the first debt relief plan.